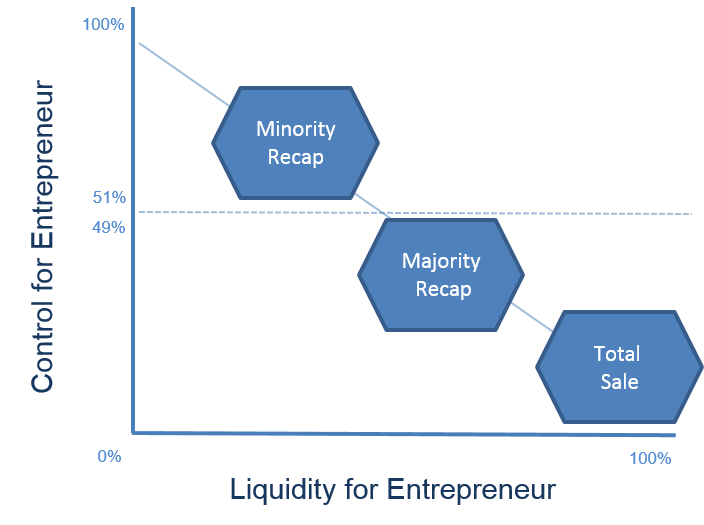

There are three types of exits: total sale, majority recap, and minority recap. These exit types form a continuum from a small minority interest to total ownership creating a trade-off between control and liquidity. Majority and minority recaps are typically the province of financial buyers (private equity, venture capital, and hedge funds) although many corporations will also make recap investments. Both strategic buyers and financial buyers purchase companies in total, although strategic buyers represent the vast majority of these acquisitions.

- Total Sale: People typically equate exits with the total sale of a company. This perspective gives pause to many entrepreneurs who discern that only two options exist: either sell the entire company or keep working. This is not the case. The total sale of the company makes sense when the entrepreneur wants to maximize the current proceeds from a transaction and is ready and willing to let go of the company. Depending on how the exit is structured, the entrepreneur may still be affiliated with the company for a period of time after the transaction, but for all intents and purposes the company belongs to new owners.

- Majority Recap: A majority recap is a viable option for an entrepreneur who still wants to work and continue growing the company, but would like to take some “chips off the table” to diversity his or her net worth. With a majority recap, buyers own the majority of the company and, consequently, control the company. The entrepreneur, however, still retains a significant ownership interest (typically in the range of 15% – 40%) and is positioned for the “second bite of the apple” when the company has its subsequent exit (typically in 4 – 7 years). A majority recap can be the best path to maximize the total return on the company.

- Minority Recap: A minority recap is an option for entrepreneurs seeking growth capital to fund expansion strategies and acquisitions. Strictly speaking, minority recaps are not exits per se since buyers of the minority interest in the company desire their funds to be used to fuel growth strategies. However, depending on the situation and the lifecycle stage of the company, some of the cash could be distributed to the entrepreneur.