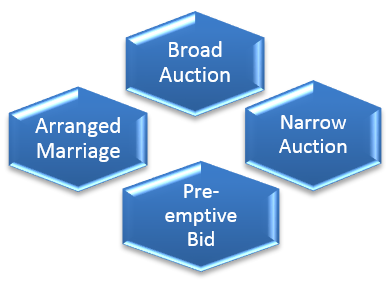

After determining the exit type, the next key decision point is determining the exit strategy to employ. There are four major categories of exit strategies: arranged marriages, preemptive bids, narrow auctions, and broad auctions.

- “Arranged marriages” work for several types of exit options and are characterized by a buyer and a seller agreeing to enter into negotiations and working out the details of a transaction. Each exit option has its own nuances and these nuances determine the skill sets needed on the transaction team. Tax implications and unintended consequences weigh large. Transactions with family members can affect family dynamics in subtle and not so subtle ways. Transactions with co-owners may be governed by buyback and first right of refusal provisions. For mid-sized businesses, ownership can be transferred to employees via an ESOP, but there are a lot of details to address setting up one of these plans. Transactions involving competitors, suppliers, or customers already known to the entrepreneur can be dicey given ongoing business and competitive relationships.

- One of the significant challenges of an arranged marriage is determining the purchase price of the company. It may seem strange at first that there is not one “single price” for a private company. In many cases, the value of the company is in the eye of the beholder as well as what the entrepreneur is willing to accept. A company, for instance, could be valued lower if it is being sold to a family member versus being sold to a competitor. The process of determining “fair market value” involves the buyer and seller agreeing to a specific amount as well as how the payment will be structured. Knowing the company’s intrinsic value, and being able to prove and defend that value, is a vital piece of knowledge for the transaction team when negotiating an arranged marriage.

- A “preemptive bid” is used as an alternative to selling the company using an auction process (explained below). A preemptive bid is utilized with a financial or strategic buyer to achieve an outcome similar to what would be produced by an auction process, but without going through the rigors and expense associated with an auction. Both parties agree to negotiate in good faith. If the entrepreneur senses the potential buyer is holding back and is not as forthcoming as they would be in an auction, then the entrepreneur always has the choice to break off negotiations and “take the company to market” via an auction. Consequently, a condition for a preemptive bid depends on the company being able to attract the interest of the Private Capital Markets. This ability to use an auction, if necessary, provides the entrepreneur with a degree of leverage to ensure negotiations are kept on track and above board. The benefit of a preemptive bid is that a deal can be done faster and with less wear and tear on the entrepreneur and his or her management team compared to an auction process.

- A “narrow auction” targets only a relatively few financial and strategic buyers who would most likely have an interest in buying all or part of the company. It takes skill and special resources to identify these candidates. The intent is to create a “competitive deal environment” consisting of multiple buyers each competing against the other to offer the best purchase price and deal structure. This competitive process lets “the market” determine how much the company is worth. The auction process consists of three major phases – packaging, marketing, and closing. There is both an art and a science to conducting a successful auction.

- A “broad auction” follows a similar path as a narrow auction, but the list of strategic and financial buyers is much broader and can number into the hundreds. The major benefit of a broad auction is that it can identify potential buyers the entrepreneur never knew existed. These potential buyers in certain circumstances may be willing to pay substantially more than the intrinsic value of the company operating as a standalone entity. In the case of majority recaps, broad auctions can surface a “value added” financial buyer that is an excellent fit and has the resources and expertise to significantly grow the company. A broad auction can take six to twelve months to complete from start to finish and places a fair degree of stress on the entrepreneur and the management team. The benefit of a broad auction is that it can lead to an outstanding result. Both narrow and broad auctions require being able to successfully access the Private Capital Markets. As can be expected, financial and strategic buyers are looking for good companies with strong performance and a competitive advantage that will drive future growth. Companies don’t have to be perfect, but they do need to be “fixable” if there are blemishes. A major challenge companies’ face is the ability to rise above other companies in their industry and get on the radar screens of financial and strategic buyers.