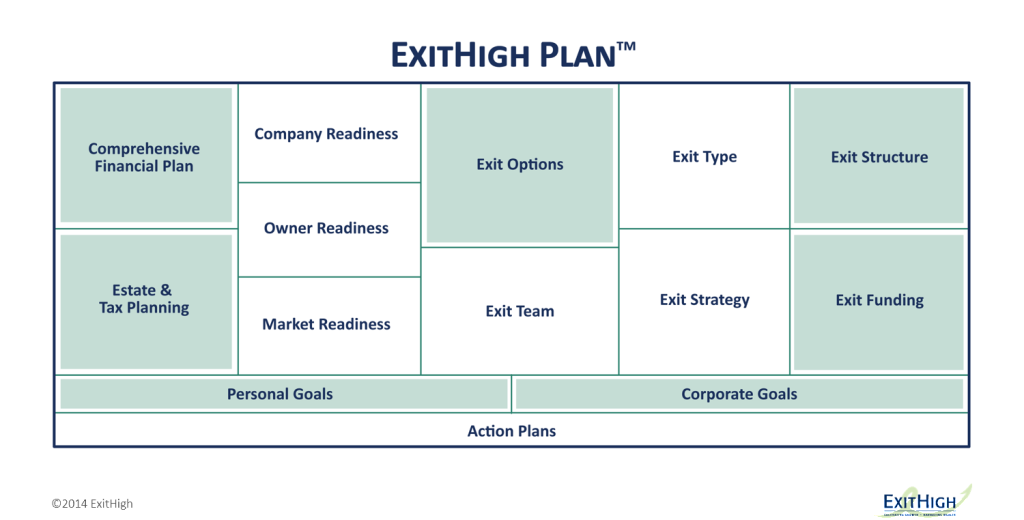

Business owners who exit wisely invest the same intensity to exiting their business as they invest building the company. They do so by taking the time to make the company more valuable prior to an exit while also getting personally prepared before transitioning ownership. The foundation of the ExitHigh Plan is a set of well defined personal and corporate goals that describe what is important to achieve and the specific outcomes to produce through an exit.

Financial, Estate, and Tax Planning

A comprehensive financial plan anchors personal goals. Planning for your personal transition is equally as important as planning for the business transaction. Understanding what you need for retirement, the legacy you want to leave your family, the reserves to set aside to cover unforeseen circumstances, how you may want to give back philanthropically, and what you want to accomplish in the next stage of your life are all intertwined. In many instances, the ownership interest in a private business forms the majority of an entrepreneur’s net worth. Devising a comprehensive financial plan for managing your net worth on the front-end of the transaction is advisable for two important reasons. First, the financial plan assists in determining the after-tax implications of different transaction structures and aids in designing the structure that best serves the interests of the business owner (given the constraints of negotiations with the buyer). Second, a financial plan greatly assists in determining if a given valuation – and the associated structure – provides the financial security the entrepreneur is seeking with a sufficient margin of safety. Financial planning also provides critical guidance for investment management, tax planning, and estate planning. Depending on the business owner’s objectives and specific circumstances, several tax and estate strategies may need to be implemented before initiating a transaction process in order to produce an optimal result.

Understanding “Readiness”

Naturally, business owners want to be paid well for their company in addition to transferring ownership in a manner that achieves corporate goals important to the entrepreneur. This requires getting the company ready by building additional value before an exit, understanding market readiness in terms of the overall environment for a transaction at a given point in time, and ensuring the owner is ready to proceed with a transaction process. Additional considerations for establishing realistic and achievable corporate goals include understanding how the size of a company matters, knowing the key to finding the best buyer, and moving the odds in your favor for getting the right deal done.

- The “size” of a company matters, especially for companies with revenue over $10 million. How companies of this size are bought and sold – and how they are valued – is not broadly understood. A group of buyers exists that form the Private Capital Markets, which collectively greatly expands the range of potential buyers and ways of structuring transactions that can be very beneficial to the business owner. However, these are sophisticated buyers who are highly skilled and knowledgeable. This can lead to an “information gap” that can put the seller at a distinct disadvantage since most owners only sell a company one or two times while sophisticated buyers buy companies for a living. A well thought through exit plan and the right exit team levels the playing field.

- The key to finding your “best buyer” is having clearly defined corporate and personal goals. Understanding the various exit options that are available to you is the essential starting point. There is a direct correlation between the preferred exit option and finding the “best buyer.” In some cases the best buyer is already known to the business owner, but in many cases the best buyer is not known and there are proven methods for finding the preferred buyer.

- The secret to getting the “right deal done” is having a comprehensive plan, building the right team, and executing an exit in a holistic manner so you attain both your corporate and your personal goals with no seller remorse.

Planning the Business Transaction

There are six key elements that shape the preferred business transaction that will need to be executed in order to achieve the outcomes specified by the personal and corporate goals.

- Understanding and selecting the various Exit Options that are available given the specific circumstances and goals of the business owner.

- Understanding Exit Structure and the implications different structures have, particularly as it relates to personal objectives.

- Determining the Exit Type that best fulfills personal and corporate goals.

- Selecting the Exit Strategy that best satisfies corporate and personal goals in a cost-effective manner.

- Understanding Exit Funding and how business owners and investors will be paid.

- Understanding the composition of the Exit Team and assembling the professional experts required to implement the exit plan.

The Role of Transaction Intermediaries

The size of the company in terms of revenue and profits – combined with the type of exit option preferred by the business owner – also plays an important role in determining if a transaction intermediary should be part of the exit team. Transaction intermediaries can facilitate finding the “best” buyer and getting a deal closed. There are two categories of transaction intermediaries: business brokers and investment bankers. While there are no hard and fast rules, typically business brokers specialize in selling companies with revenues under $5 million and investment bankers specialize in selling companies with revenues over $10 million. The gap between $5 and $10 million is filled by smaller “boutique” investment bankers and some business brokers. The sale process used by business brokers differs from the process used by investment bankers. In short, business brokers specialize in “listing” companies while investment bankers specialize in running an “auction” process. It is not a requirement to use a transaction intermediary for an exit. In many situations, a transaction intermediary is not needed. However, a transaction intermediary can add substantial value in the right situation and serve as a key member of the transaction team by identifying a preferred buyer not previously known to the entrepreneur, assisting with negotiations, and driving the process forward to getting the deal closed.

The Private Capital Markets and the Role of Sophisticated Buyers

The Private Capital Markets provide access to capital and are a source of buyers (and investors) with the capacity to purchase all or a part of medium-sized companies. The ability for a company to access the Private Capital Markets significantly expands the range of qualified buyers. In addition to providing “liquidity,” sophisticated buyers can also add considerable value by providing resources and capabilities to help companies grow and reach their full potential.

The Entrepreneurial Lifecycle

The Entrepreneurial Lifecycle is a big picture view of the cycle of growing and exiting a business. Understanding this progression can help business owners, investors, and advisors prepare for the next stage.